Time series analysis of armed robberies in Boston

Data: Monthly armed robberies

Techniques: ARIMA models, stationarity tests, differencing

This project looks at monthly Boston armed robberies from Jan 1966-Oct 1975. Here I build a quick ARIMA model to forecast robberies.

Data originally from : McCleary & Hay (1980)

%matplotlib inline

import sys

import pandas as pd

import numpy as np

from datetime import datetime

from statsmodels.tsa.stattools import adfuller

from statsmodels.tsa.seasonal import seasonal_decompose

from statsmodels.tsa.stattools import acf, pacf

from statsmodels.tsa.arima_model import ARIMA

import matplotlib.pylab as plt

from matplotlib.pylab import rcParams

rcParams['figure.figsize'] = 15, 6

print('Python version: %s.%s.%s' % sys.version_info[:3])

print('numpy version:', np.__version__)

print('pandas version:', pd.__version__)

Python version: 3.5.2

numpy version: 1.11.1

pandas version: 0.18.1

def check_stationarity(timeseries):

# Determine rolling statistics (moving averages and variance)

rolmean = pd.rolling_mean(timeseries, window=12)

rolstd = pd.rolling_std(timeseries, window=12)

# Plot rolling statistics:

orig = plt.plot(timeseries, color='blue',label='Original')

mean = plt.plot(rolmean, color='red', label='Rolling Mean')

std = plt.plot(rolstd, color='black', label = 'Rolling Std')

plt.legend(loc='best')

plt.title('Rolling Mean & Standard Deviation')

plt.show(block=False)

# Perform Dickey-Fuller test:

print('Results of Dickey-Fuller Test:')

dftest = adfuller(timeseries, autolag='AIC')

dfoutput = pd.Series(dftest[0:4], index=['Test Statistic','p-value','#Lags Used','Number of Observations Used'])

for key,value in dftest[4].items():

dfoutput['Critical Value (%s)'%key] = value

print(dfoutput)

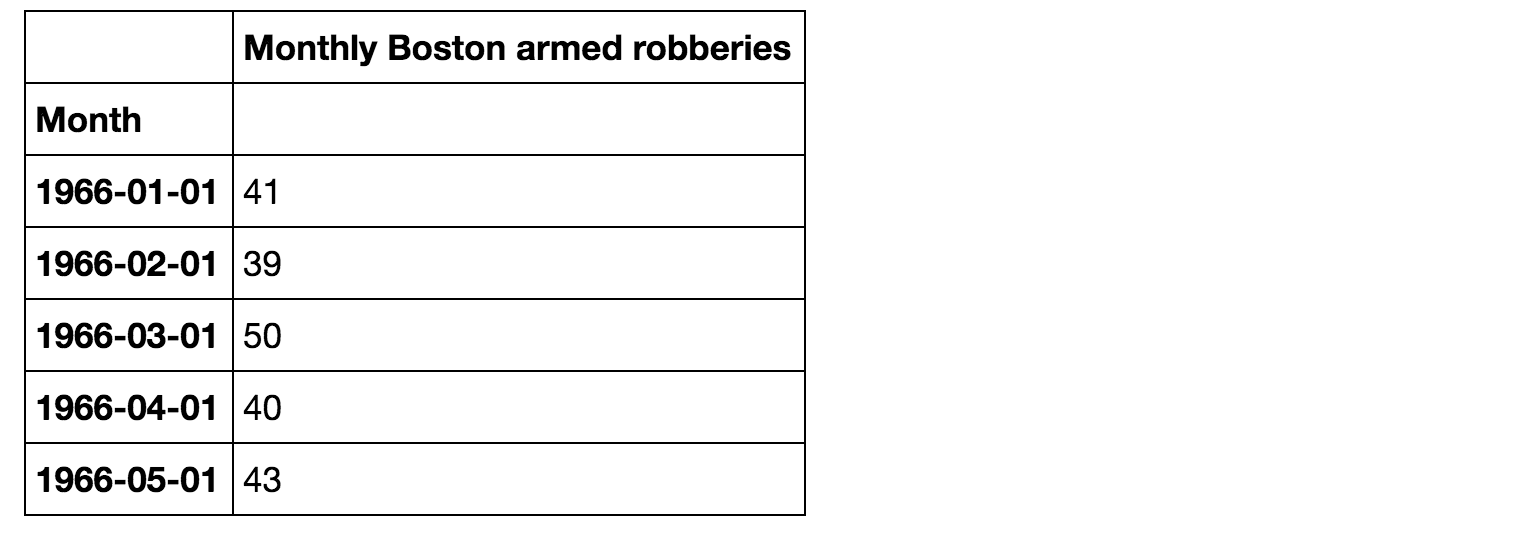

The data

data = pd.read_csv('monthly-boston-armed-robberies-j.csv',parse_dates=True, index_col='Month')

data.head()

data.dtypes

Monthly Boston armed robberies int64

dtype: object

# To confirm that dtype=datetime, or that it is a datetime object

data.index

DatetimeIndex(['1966-01-01', '1966-02-01', '1966-03-01', '1966-04-01',

'1966-05-01', '1966-06-01', '1966-07-01', '1966-08-01',

'1966-09-01', '1966-10-01',

...

'1975-01-01', '1975-02-01', '1975-03-01', '1975-04-01',

'1975-05-01', '1975-06-01', '1975-07-01', '1975-08-01',

'1975-09-01', '1975-10-01'],

dtype='datetime64[ns]', name='Month', length=118, freq=None)

# Converting to a series object for convenience

ts = data['Monthly Boston armed robberies']

ts.head()

Month

1966-01-01 41

1966-02-01 39

1966-03-01 50

1966-04-01 40

1966-05-01 43

Name: Monthly Boston armed robberies, dtype: int64

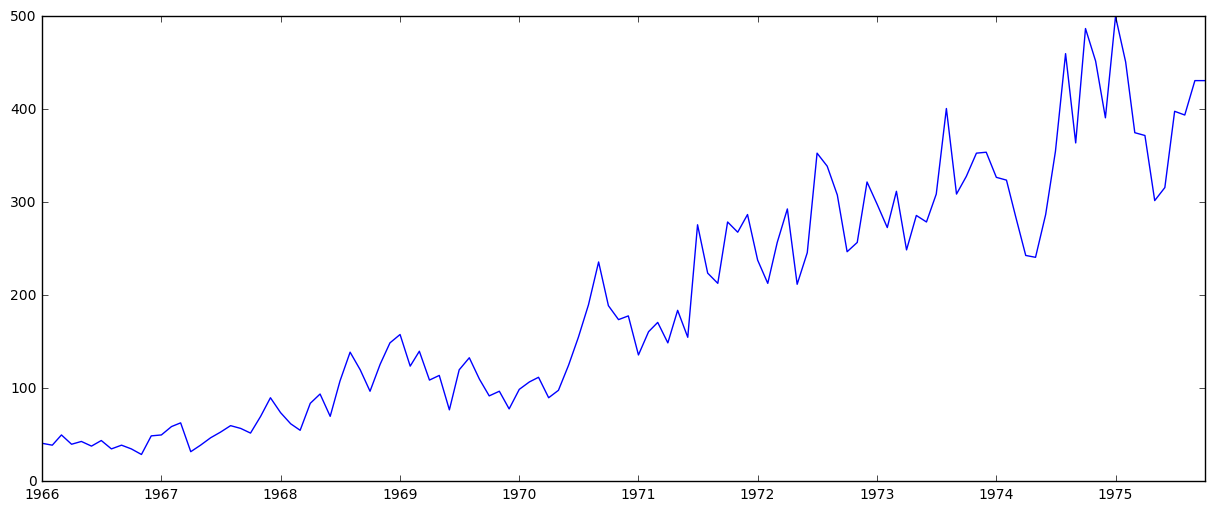

Check stationarity

plt.plot(ts)

It’s clear that there’s an overall increasing trend, and the time series is clearly not stationary, but let’s look at the moving averages/variance and implement the Dickey-Fuller test for stationarity:

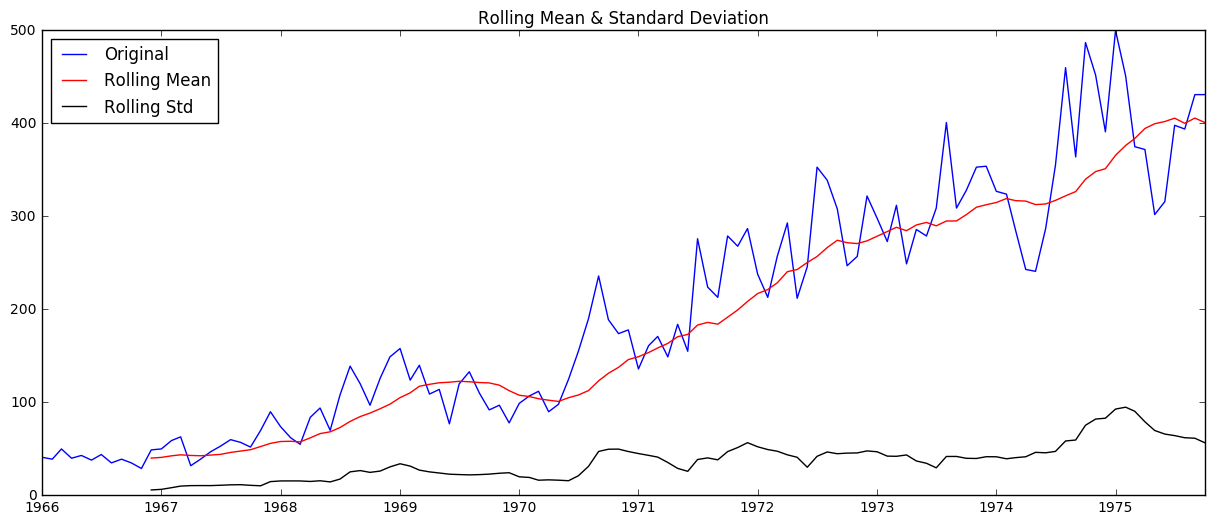

check_stationarity(ts)

Results of Dickey-Fuller Test:

Test Statistic 1.001102

p-value 0.994278

#Lags Used 11.000000

Number of Observations Used 106.000000

Critical Value (1%) -3.493602

Critical Value (10%) -2.581533

Critical Value (5%) -2.889217

dtype: float64

The mean (in red) is clearly increasing with time and the test statistic is much larger than the critical values, so we can’t reject the null hypothesis- aka this is not a stationary series.

Make the series stationary

Eliminating trend

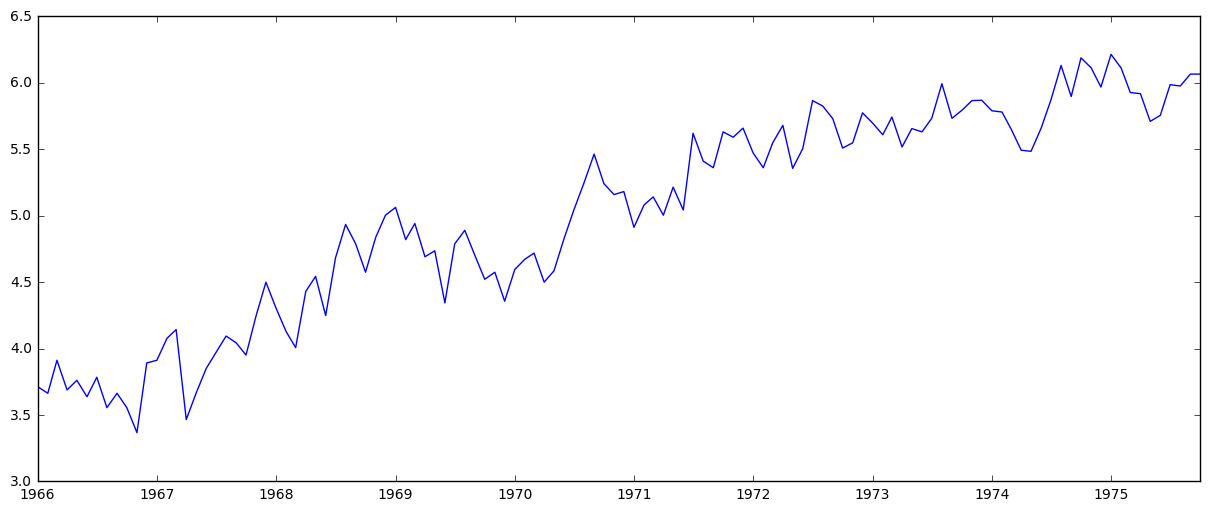

In this case there is a significant positive trend. Let’s first work on estimating and eliminating it. We can do a simple log transform (which would penalize higher values more than smaller ones).

ts_log = np.log(ts)

plt.plot(ts_log)

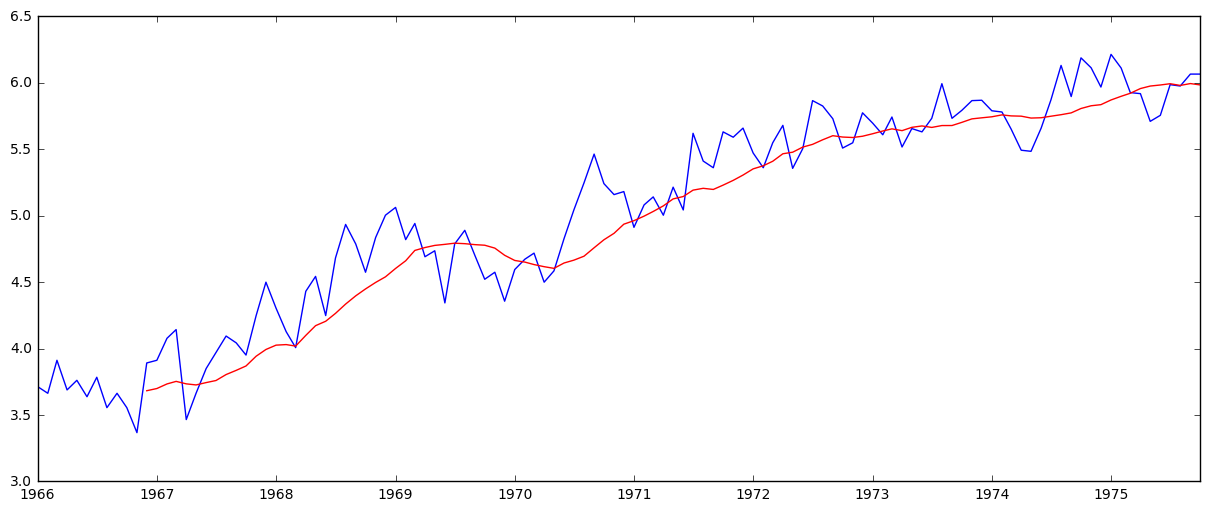

As well as smoothing by taking rolling averages:

moving_avg = pd.rolling_mean(ts_log,12)

plt.plot(ts_log)

plt.plot(moving_avg, color='red')

The red shows the rolling average. Now subtract it from the original series.

Note: since we are taking the mean of the last 12 values, rolling mean is not defined for the first 11 values:

# Subtract rolling average

ts_log_moving_avg_diff = ts_log - moving_avg

ts_log_moving_avg_diff.head(12)

Month

1966-01-01 NaN

1966-02-01 NaN

1966-03-01 NaN

1966-04-01 NaN

1966-05-01 NaN

1966-06-01 NaN

1966-07-01 NaN

1966-08-01 NaN

1966-09-01 NaN

1966-10-01 NaN

1966-11-01 NaN

1966-12-01 0.208955

Name: Monthly Boston armed robberies, dtype: float64

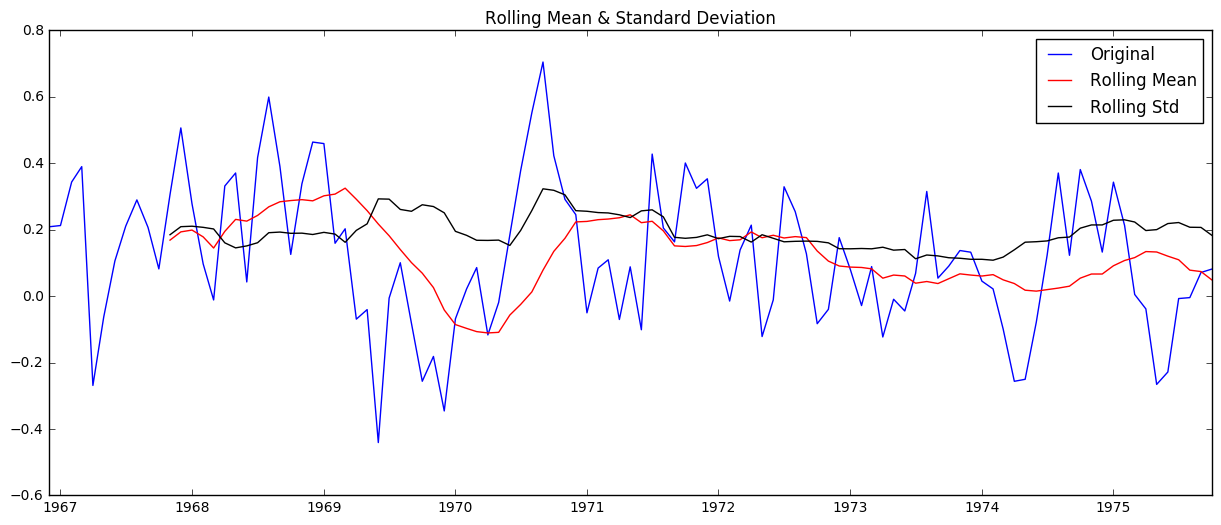

So the first 11 are Nan. Let’s drop these and then check for stationarity again:

ts_log_moving_avg_diff.dropna(inplace=True)

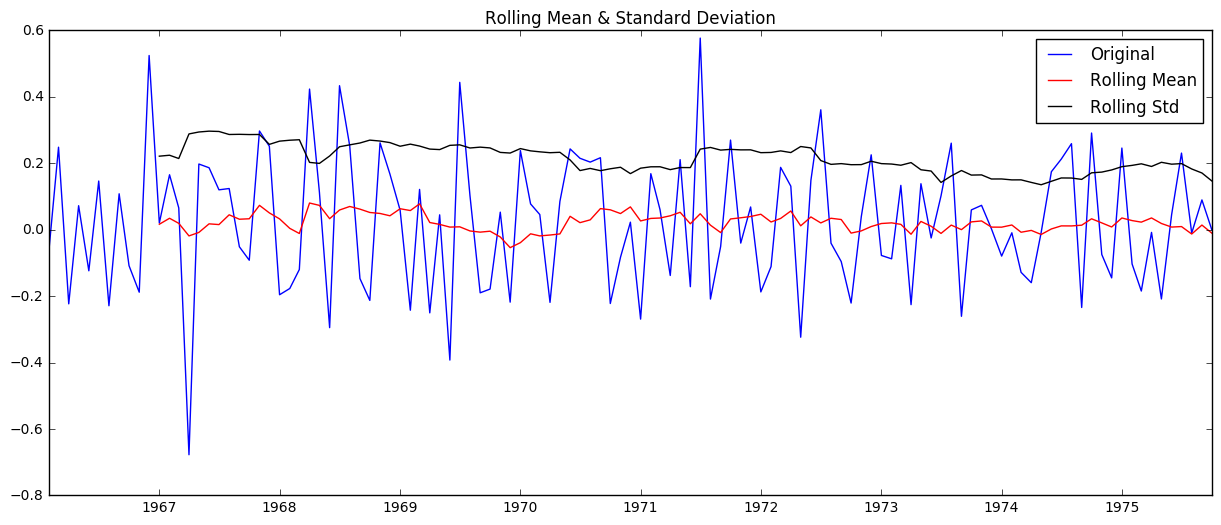

check_stationarity(ts_log_moving_avg_diff)

Results of Dickey-Fuller Test:

Test Statistic -5.323692

p-value 0.000005

#Lags Used 0.000000

Number of Observations Used 106.000000

Critical Value (1%) -3.493602

Critical Value (10%) -2.581533

Critical Value (5%) -2.889217

dtype: float64

Now we get a test statistic that is smaller than the 1% critical value.

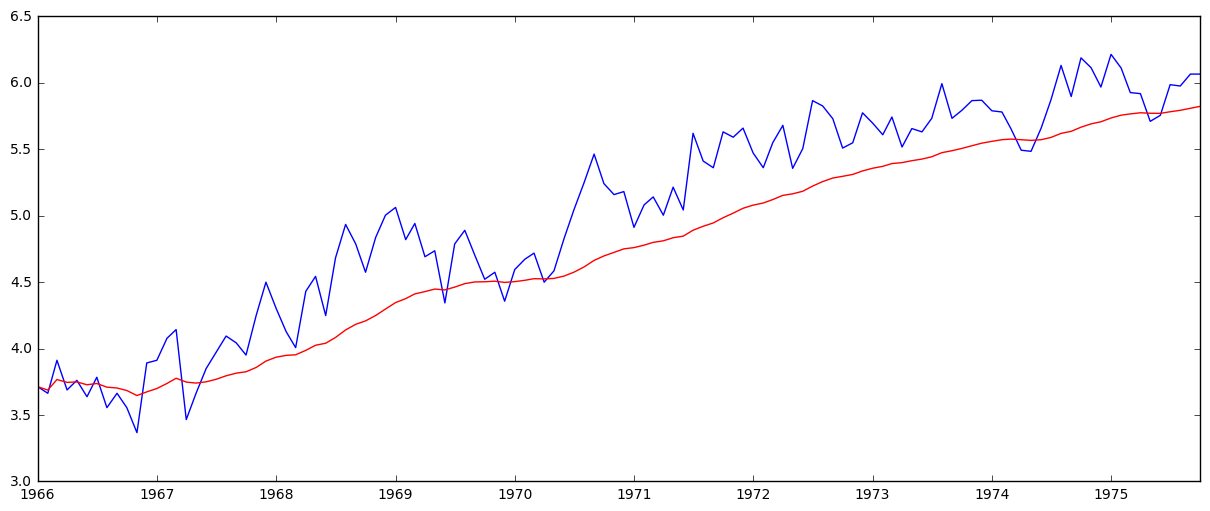

Now let’s try a weighted moving average (where more recent values get higher weight)- more specifically an exponentially weighted moving average, where weights are assigned to all the previous values with a decay factor:

expwighted_avg = pd.ewma(ts_log, halflife=12)

plt.plot(ts_log)

plt.plot(expwighted_avg, color='red')

Now we remove this from the series and check for stationarity:

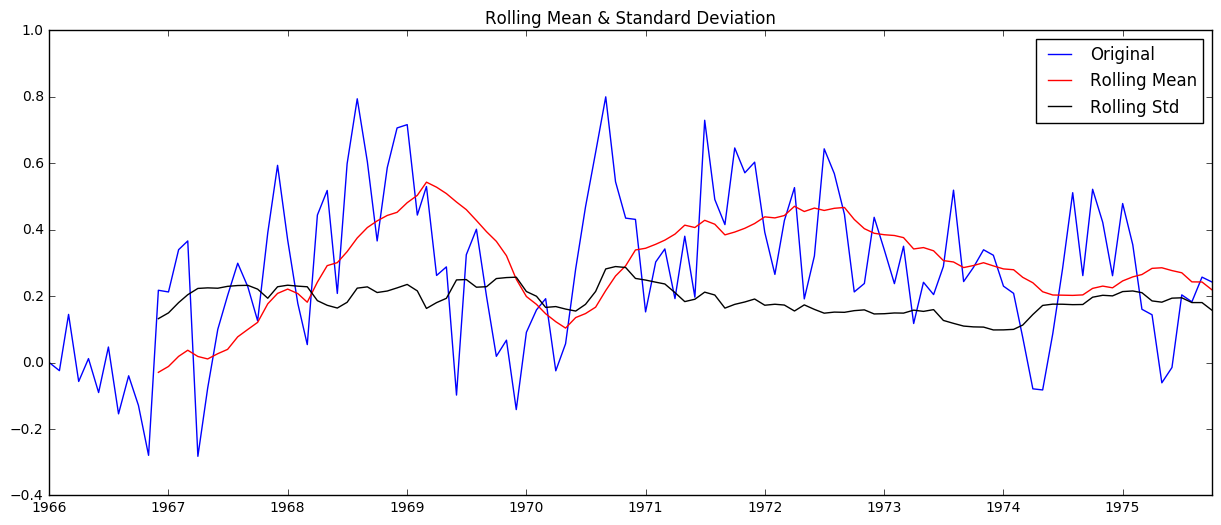

ts_log_ewma_diff = ts_log - expwighted_avg

check_stationarity(ts_log_ewma_diff)

Results of Dickey-Fuller Test:

Test Statistic -5.155717

p-value 0.000011

#Lags Used 0.000000

Number of Observations Used 117.000000

Critical Value (1%) -3.487517

Critical Value (10%) -2.580124

Critical Value (5%) -2.886578

dtype: float64

This actually isn’t better than the previous method of using the simple moving average.

Removing trend and seasonality with differencing

Now let’s try another method of removing trend, as well as seasonality: differencing.

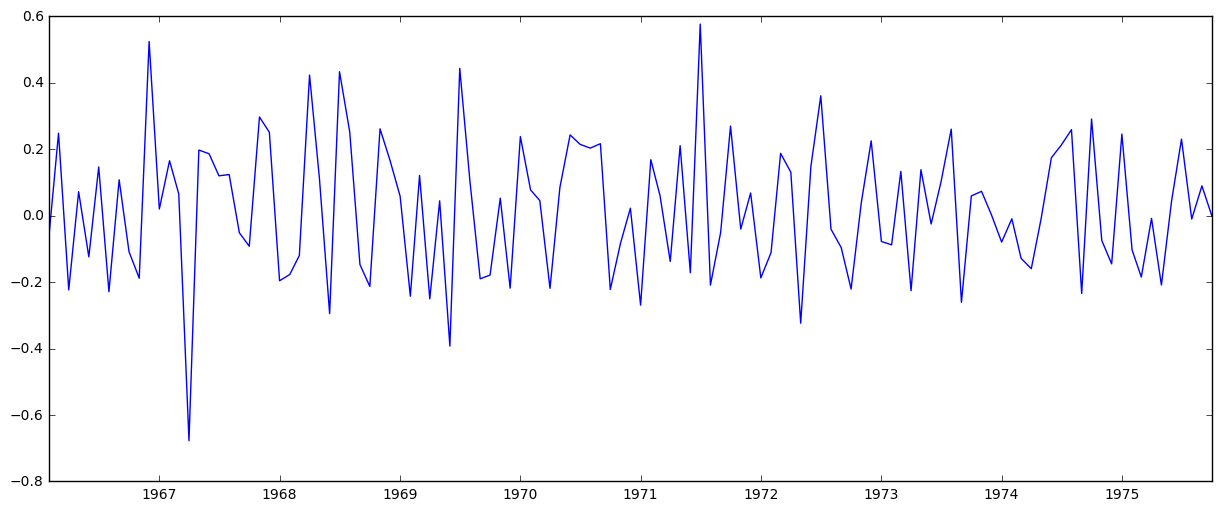

ts_log_diff = ts_log - ts_log.shift()

plt.plot(ts_log_diff)

The trend looks like it’s gone.

Check stationarity:

ts_log_diff.dropna(inplace=True)

check_stationarity(ts_log_diff)

Results of Dickey-Fuller Test:

Test Statistic -7.601792e+00

p-value 2.378602e-11

#Lags Used 3.000000e+00

Number of Observations Used 1.130000e+02

Critical Value (1%) -3.489590e+00

Critical Value (10%) -2.580604e+00

Critical Value (5%) -2.887477e+00

dtype: float64

Again, the test statistic is significantly lower than the 1% critical value so this time series is very close to stationary.

Forecasting

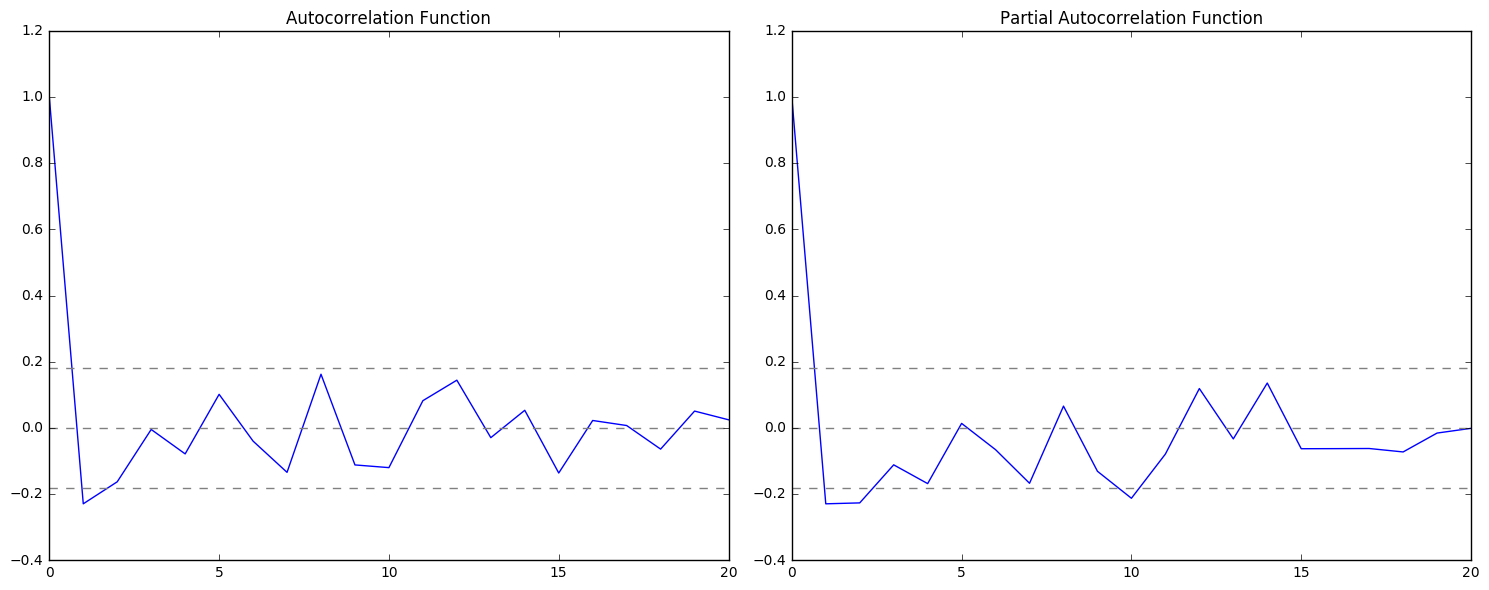

For ARIMA we need the parameters p, d, and q. Here d is the number of nonseasonal differences. We use these plots to determine p and q:

# ACF (autocorrelation function) and PACF (partial autocorrelation function) plots:

lag_acf = acf(ts_log_diff, nlags=20)

lag_pacf = pacf(ts_log_diff, nlags=20, method='ols')

# Plot ACF:

plt.subplot(121)

plt.plot(lag_acf)

plt.axhline(y=0,linestyle='--',color='gray')

plt.axhline(y=-1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.axhline(y=1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.title('Autocorrelation Function')

# Plot PACF:

plt.subplot(122)

plt.plot(lag_pacf)

plt.axhline(y=0,linestyle='--',color='gray')

plt.axhline(y=-1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.axhline(y=1.96/np.sqrt(len(ts_log_diff)),linestyle='--',color='gray')

plt.title('Partial Autocorrelation Function')

plt.tight_layout()

The two dotted lines on either sides of 0 are confidence intervals. These can be used to determine ‘p’ and ‘q’ values as (p: the lag value where the PACF chart crosses the upper confidence interval for the first time, q: the lag value where the ACF chart crosses the upper confidence interval for the first time).

It looks like p is roughly 1 and q is roughly equal to 1. For now I will use these values to build a model and come back to refining later.

ARIMA

For now I’ll justtry 3 different ARIMA models considering individual as well as combined effects.

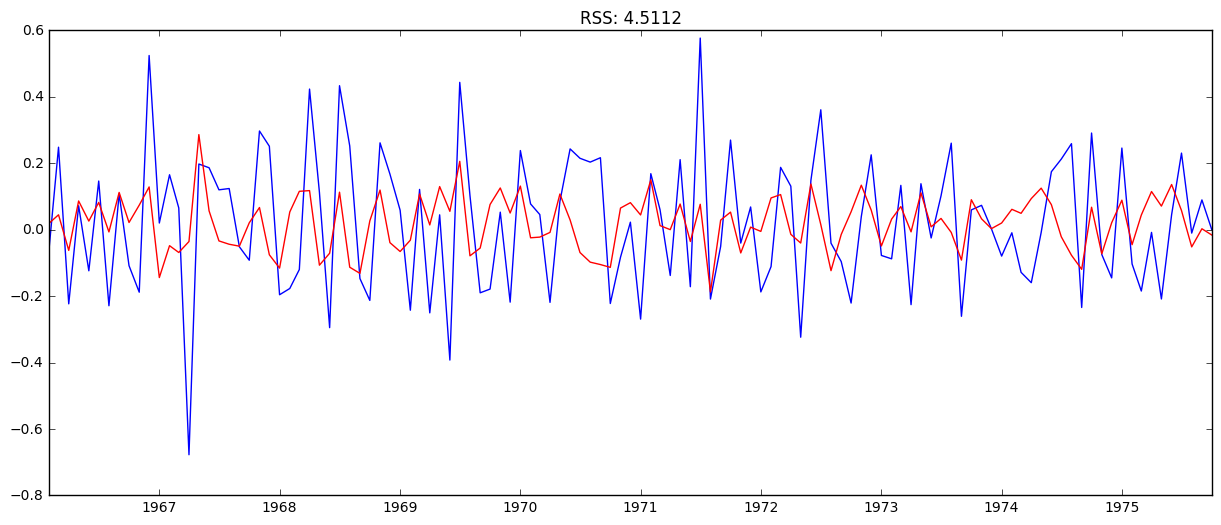

# AR (auto-regression) model

model = ARIMA(ts_log, order=(1, 1, 0)) # (p,d,q)

results_AR = model.fit(disp=-1)

plt.plot(ts_log_diff)

plt.plot(results_AR.fittedvalues, color='red')

# Print the RSS- values for the residuals

plt.title('RSS: %.4f'% sum((results_AR.fittedvalues-ts_log_diff)**2))

# MA (moving avg) model

model = ARIMA(ts_log, order=(0, 1, 1))

results_MA = model.fit(disp=-1)

plt.plot(ts_log_diff)

plt.plot(results_MA.fittedvalues, color='red')

plt.title('RSS: %.4f'% sum((results_MA.fittedvalues-ts_log_diff)**2))

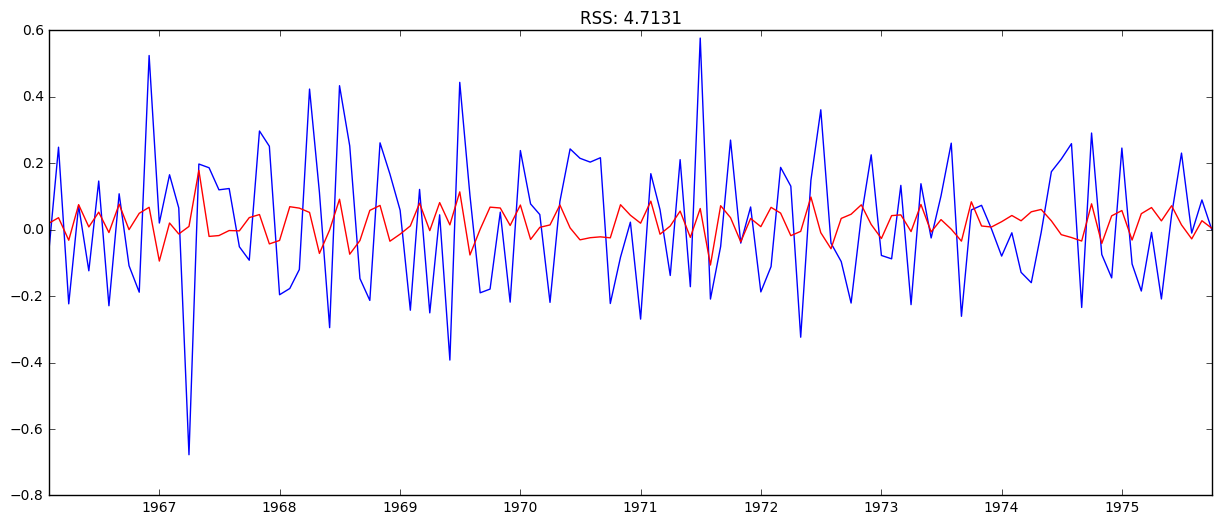

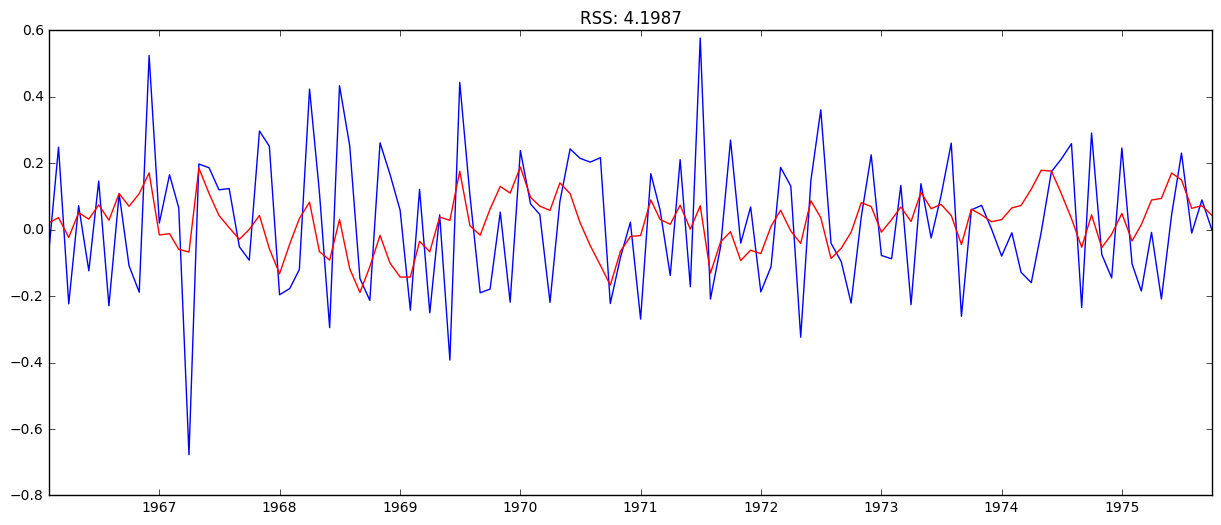

# Combined model

model = ARIMA(ts_log, order=(1, 1, 1))

results_ARIMA = model.fit(disp=-1)

plt.plot(ts_log_diff)

plt.plot(results_ARIMA.fittedvalues, color='red')

plt.title('RSS: %.4f'% sum((results_ARIMA.fittedvalues-ts_log_diff)**2))

The combined gave the lowest RSS.

Next we take these values back to the original scale:

Back to the original scale

Scaling back to the original values:

predictions_ARIMA_diff = pd.Series(results_ARIMA.fittedvalues, copy=True)

print(predictions_ARIMA_diff.head())

Month

1966-02-01 0.021240

1966-03-01 0.036438

1966-04-01 -0.023285

1966-05-01 0.051275

1966-06-01 0.031915

dtype: float64

Convert differencing to log scale by adding these difference consecutively to the base number. One way to do that is to first determine the cumulative sum at index, then add it to the base number. Cumulative sum:

predictions_ARIMA_diff_cumsum = predictions_ARIMA_diff.cumsum()

print(predictions_ARIMA_diff_cumsum.head())

Month

1966-02-01 0.021240

1966-03-01 0.057678

1966-04-01 0.034392

1966-05-01 0.085667

1966-06-01 0.117582

dtype: float64

Next we add them to the base number, First create a series with all values as base number and add differences to it:

predictions_ARIMA_log = pd.Series(ts_log.ix[0], index=ts_log.index)

predictions_ARIMA_log = predictions_ARIMA_log.add(predictions_ARIMA_diff_cumsum,fill_value=0)

predictions_ARIMA_log.head()

Month

1966-01-01 3.713572

1966-02-01 3.734812

1966-03-01 3.771250

1966-04-01 3.747964

1966-05-01 3.799239

dtype: float64

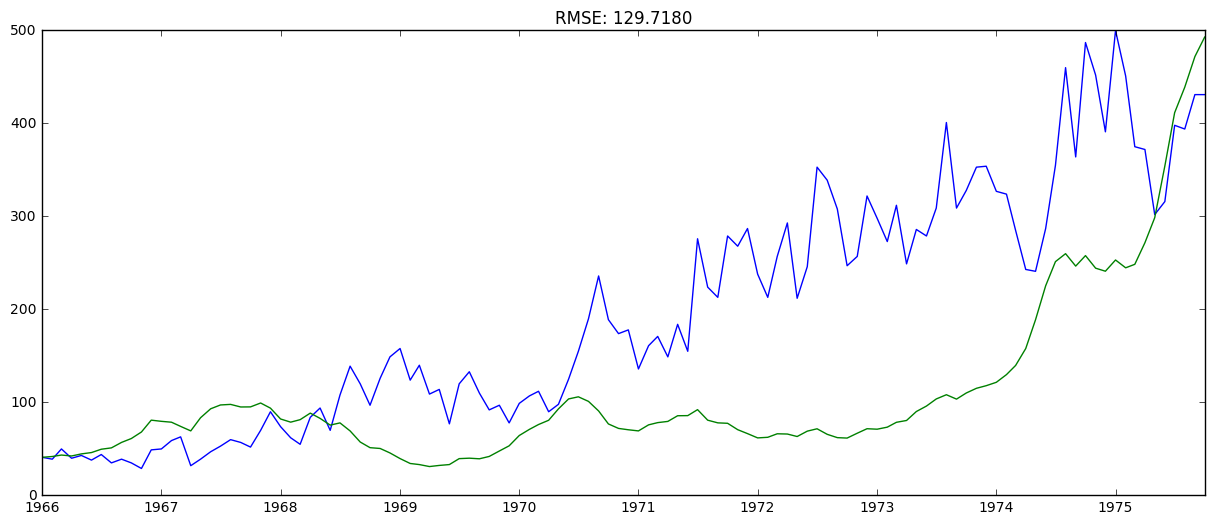

Then take the exponent and compare with the original series.

predictions_ARIMA = np.exp(predictions_ARIMA_log)

plt.plot(ts)

plt.plot(predictions_ARIMA)

plt.title('RMSE: %.4f'% np.sqrt(sum((predictions_ARIMA-ts)**2)/len(ts)))

And that’s the forecast at the original scale. It’s not great; this was just a quick and dirty forecast, but after this, I’ll come back and refine the model by:

- Using seasonal ARIMA, for which I would need to find (p,d,q,P,D,Q) values.

- Get a holdout sample (validatiaon set) using recent past data points.

- Run through different parameter values and get the values that give the lowest error on the validation set.